Music happy red Friday afternoon little ba TradeStation. Hey, thanks for hanging out with us again on a Friday afternoon. It's a great summer, it's hot but it is not Middle Eastern hot yet today here in Utah. So our topic for Friday afternoons is the difference between FHA, VA, and USDA loans. All of these are government-backed products that American citizens can take advantage of to purchase a home or maybe do a refinance. Let's look at some of the specifics for these today. We'll start by looking at the loan-to-value ratios. On a USDA loan, you can actually finance up to a hundred percent of the value. FHA allows for 96.5 percent financing, and VA also allows for a hundred percent financing. So, for example, on a $200,000 house, you wouldn't have to have any down payment money for either a USDA or a VA loan. However, on an FHA loan, you would need to have about seven thousand dollars in savings just for your down payment. It may take you a while to save that much money. Another factor to consider when looking at loans is the loan limits. USDA loans allow you to go up to the conforming loan amount limit of $424,100. FHA loans, on the other hand, have county-specific limits. Each county throughout America has a different limit. So, for example, if you're from Nebraska, you're going to have a lower limit because of rural America, compared to the metro area of Salt Lake City. VA loans allow you to go higher than $424,100, so it gives you greater purchasing power. Now, let's talk about credit criteria, specifically the FICO score. USDA loans require a minimum FICO score of 640. FHA loans have a lot of lending institutions that require around a 680 score....

Award-winning PDF software

Fha va lead standard certification for water systems Form: What You Should Know

I CERTIFY that the above property is being repaired, upgraded, remodeled or refurbished to meet LEED requirements and has appropriate LEED certification certificates for Energy Star standards as shown in the LEED website Get Form 2. Certificate to verify that you have been certified Income Based Mortgage Is this a commercial property or a rental property? Is the rental property owner liable for the principal mortgage amount plus any additional interest payments? Get Form 2. A mortgage statement to show the amount of your monthly mortgage payments. Get Form 2. A statement about the lender in the event of foreclosure or repossession Get Form 2 from the seller if you buy a home with a down payment. Get Form 2 from the lender if they sell the property. A tenant may be evicted for non-payment of rent. The landlord's delinquent interest balance could be considered as “fault” in a lawsuit to recover such arrears. You are required to be registered at your property with the Department of Internal Revenue to get a 1040EZ or 1040A (tax). This form covers the following information: (a) the owner's tax ID code or other identifier (i.e. Social Security number and date of birth); (b) the name and address of the owner that is required to maintain the property's tax account; (c) the name and address of the person who maintains the owner's tax account; (d) the amount of the monthly mortgage payments; (e) the amounts paid on the installment loan and the original maturity date of the installment loan, if any, if applicable; (f) the monthly rent amounts (including amounts for security deposits, taxes, insurance and upkeep); (g) the number of units on the mortgage in the building (plus the amounts for security deposits, taxes, insurance and upkeep) in accordance with Section 561.9 of the Residential Mortgagee homeowners' Loan Act (RHODA) and Section 561.

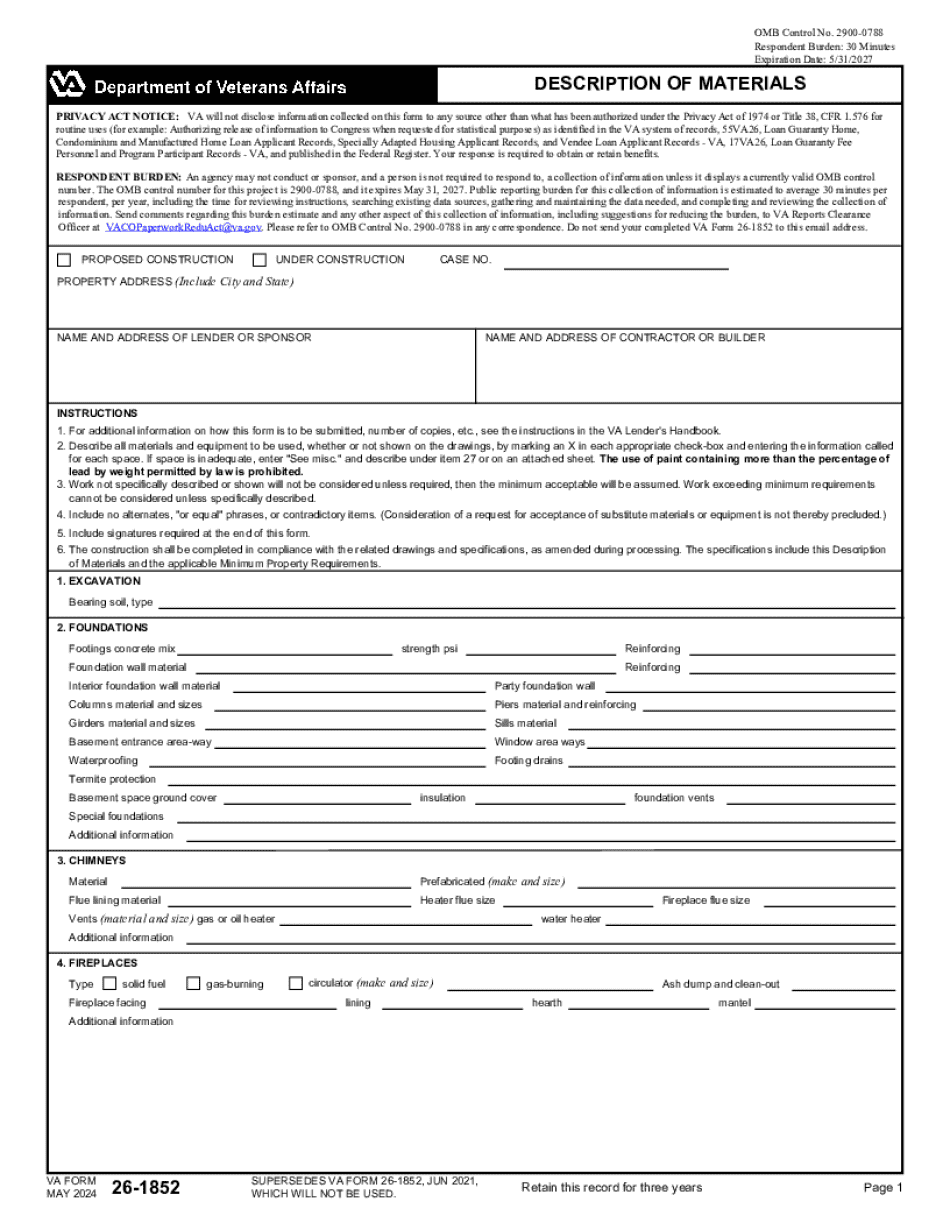

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Va 26-1852, steer clear of blunders along with furnish it in a timely manner:

How to complete any Va 26-1852 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Va 26-1852 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Va 26-1852 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fha va lead standard certification for water systems