Welcome! FHA loans remain one of the most popular mortgage programs available today for first-time homebuyers and move-up buyers alike. Today, we're going to discuss the latest requirements for FHA loans. Homebuyers that have questions, be sure to reach out to us by visiting FHAmortgagesource.com or simply call 1-877-675-3354. Throughout the country, there are select high-cost locations that permit higher loan amounts, and we're going to look at that in more detail in some slides coming up. The minimum down payment is currently 3.5% for FHA loans. FHA comes in a standard 30-year fixed and 15-year fixed terms. It is, of course, a government-backed mortgage program. There are no early payoff penalties with the program. Most lenders and banks generally require a credit score of 580 to 620 for the maximum financing of 96.5% with a 3.5% down payment. FICO scores as low as 500 can be approved for homebuyers that have a larger down payment of 10%. The credit score requirements do change depending on the down payment the homebuyer has. The homebuyer's closing costs can be paid by the seller, up to six percent, which is generally more than enough to cover the homebuyer's closing costs and prepaid escrows for taxes and homeowners insurance. FHA mortgage insurance premium is required, like most government loans out there (VA loans, USDA loans, etc.). FHA loans have a one-time premium that is rolled into the balance of the loan. FHA loans can be used for any single-family home, townhome, or approved FHA condo, as long as it meets the basic FHA requirements. A couple of notes here: for the down payment, gift funds are permitted, and the borrower/homebuyer can receive a gift from eligible sources like the employer or approved down payment assistance programs. The minimum down payment is three and...

Award-winning PDF software

Fha builder id numbers Form: What You Should Know

FHA Loan — Wells Fargo If required by the Wells Fargo loan agreement, enter your name and loan amount (if applicable). Fannie Mae Loans: FHA Loan — Freddie Mac If a mortgage is needed, enter your name, the Fannie Mae-provided address of the borrower, the name and location Housing Inventory Update Form This form asks the following questions: · Why are you applying for a loan or grant? In what areas are you located? What type of project you are executing? [If not specific, please enter a general description of the project.] Please provide the name of a sponsoring lender in your area. If multiple lenders are sponsoring the project, state the total amount of mortgage loans to be sponsored. Please note: If the project is for new construction, then the project must have commenced before September 18, 2007. If you purchased the property in 2006, then it is not eligible for the Federal Housing Affordability Program and the form is not needed. If you received a FHA-backed mortgage in a previous housing assistance cycle, please indicate the date of the mortgage loan. [A new house must not be constructed after the date on which the previous purchase agreement was terminated.] HUD-Loan Approval Form: HUD Approval Form This form gives HUD permission to use HUD approved designations on your house, home office, workshop, etc. When submitted, the form must be signed by an authorized HUD Contractor who is familiar with our programs. This forms asks the following questions: · Who did the construction work for which the award can be granted? · What is your employment status and name? · Are additional construction required at this time? · Have you previously submitted this form? If you know the answers to these or any similar questions, this form is for you. If you don't have the answers, or you don't meet the specifications, do not use the form. Lender Authorization for Purchase of a Home for a Project Located in an Existing Housing Authority This form asks a number of questions, including the following: Name and Location of the Applicant Purchasing the Home Address of Purchasing the Home Applicant's Employment Status (see Question 6 in the FHA One-Time Close Construction Mortgage for more information on employment status.

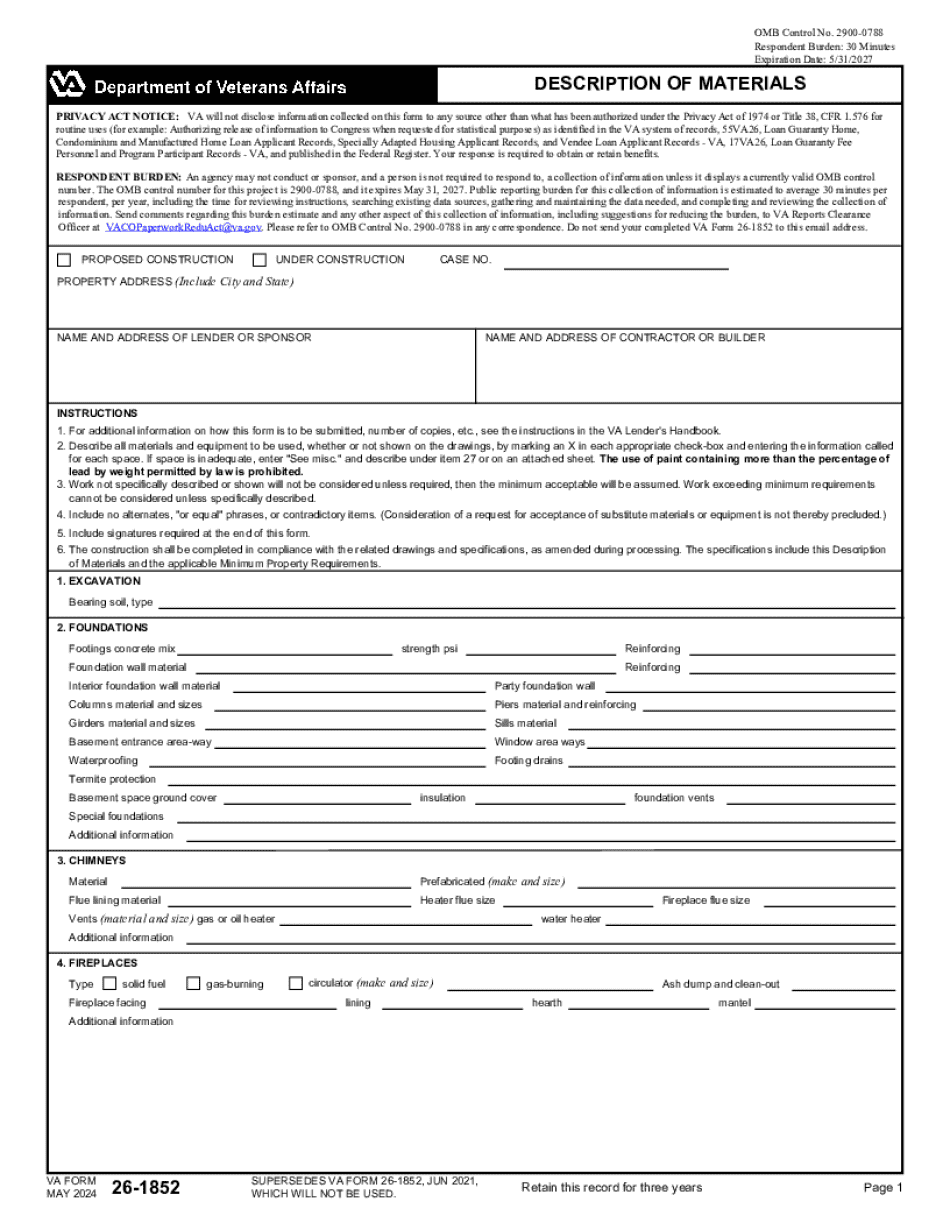

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Va 26-1852, steer clear of blunders along with furnish it in a timely manner:

How to complete any Va 26-1852 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Va 26-1852 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Va 26-1852 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fha builder id numbers