Hey everyone, this is ranks Robinson, your favorite Florida lender. This is just a quick video to explain how the VA loan program works. VA loans are one of my best and favorite types of loans to do. They honor veterans who have served our country and provide them with an excellent loan program that is not available to anyone else in the market. The main advantage of VA loans is that there is no money down payment required. For example, if you buy a house for $200,000, there is no need for a down payment. The same goes for a $300,000 purchase - no down payment required. It's good to know that the maximum VA loan in Florida is $417,000. If you go over that amount, you will no longer qualify for a no money down payment. Unlike other loans, VA loans do not require monthly mortgage insurance. Normally, you would have to put 20% down to eliminate mortgage insurance, but with a VA loan, you automatically get what they call "no PMI" on the loan. Another great feature of VA loans is that they work with different credit scores. You don't have to have perfect credit to qualify for a VA loan. In fact, we have some programs that go as low as a 580 credit score. Furthermore, VA loans do not require any reserves. With a normal loan, you would have to show that you have extra money available for the loan payments. But with a VA loan, this is not necessary. While VA loans do not require a down payment, there are still closing costs and escrows to consider. The seller can contribute up to 6% of the purchase price towards your closing costs. I have helped many veterans who came to closing with no down payment and no money down...

Award-winning PDF software

Va approved home builders florida Form: What You Should Know

Time as 90 minutes. It's not complicated at all, just a little time-consuming when your Need help? — Call us at or e-mail us at to receive an appointment. Contact the VA to obtain a VA Builder ID Number The VA and Home Loans is Your VA approved home lender is an arm of the federal government and therefore your mortgage company is also a federal agency. The Veterans Administration (VA), by federal law, is the sole purchaser for any VA home loan. That means your VA home loan comes with a VA builder name, builder ID number, and, of course, the “VA” in the title. There is no way to purchase a home in the private market with the VA builder, as it does not have private lenders. The VA Home Loans is not a real mortgage because it is a loan made by the government and is therefore not considered by many in the mortgage market as a traditional lender. The VA Builder ID Number is a unique number that must be provided by the borrower in order to receive an appraisal report from the builder. Because it is assigned to a “VA approved home builder,” it is important to make sure your loan has the builder ID number. That is why it is critical that you have a copy of the VA home loan from each of your home loans and check them all. If you were to apply for each loan independently, you would require a letter from the appraiser to your bank or credit union confirming that the appraisal is for the home that you need the loan for. But, the builder ID number is a requirement for the lender to recognize your VA home loan in their records. That is why it is also important that in the appraisal report and loan application, there is a listing of the builder ID number. You cannot get the builder ID number without a copy of the written appraisal you received. You can send the appraiser a copy of the appraisal report and the loan application for all your loans. Make sure you do not receive a payment or a written agreement on the appraisal or loan application that is not written for your mortgage account or that may have your personal name in it. If you have a question or a concern about this process, you can contact the National Consumer Assistance Center at or by fax.

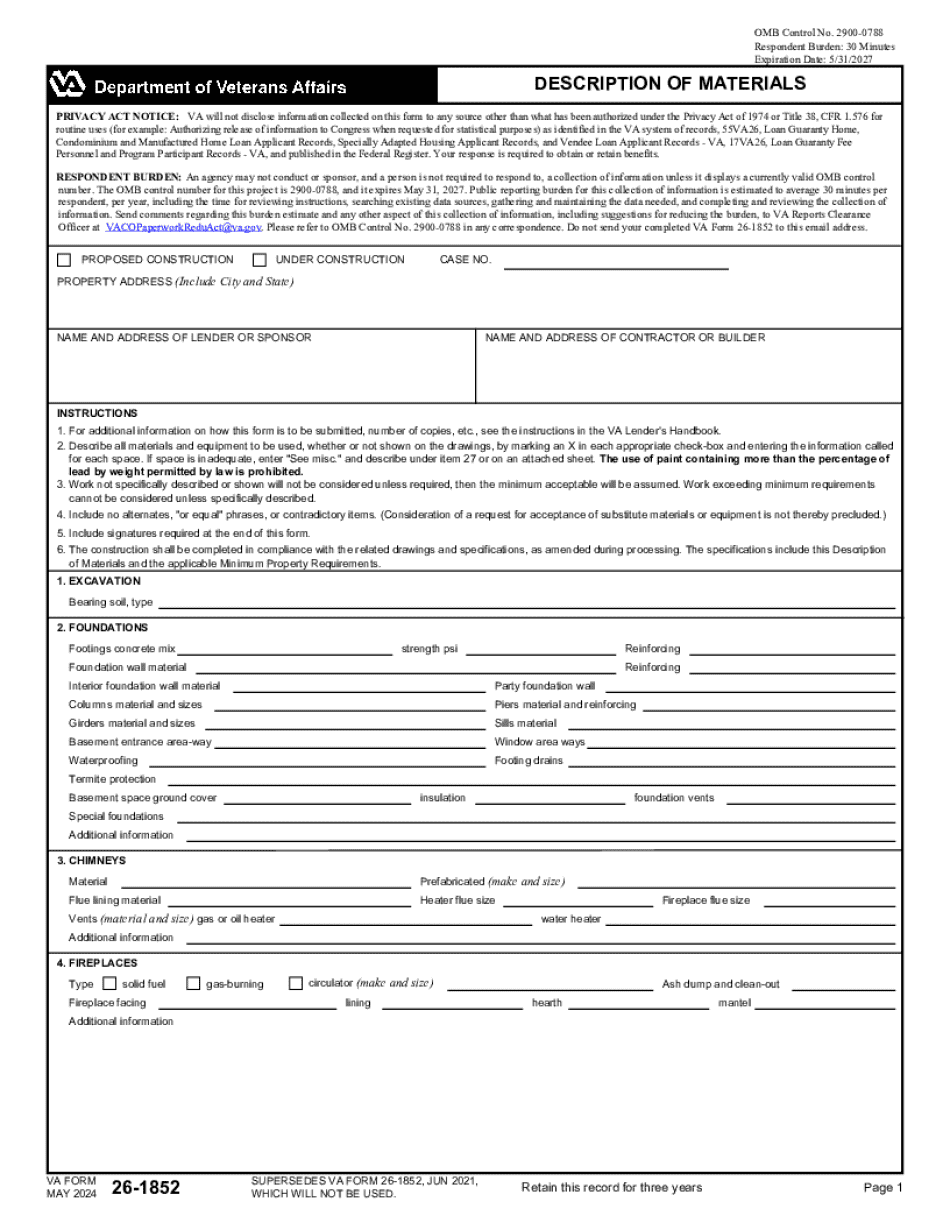

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Va 26-1852, steer clear of blunders along with furnish it in a timely manner:

How to complete any Va 26-1852 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Va 26-1852 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Va 26-1852 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Va approved home builders florida