Award-winning PDF software

Va construction loan builders Form: What You Should Know

VA Title III Bank Loan May 25, 2018–There are two types of VA Title III Bank Loans. Title I and Title II. Title I is for VA homebuyers only while Title II is for non-VA homebuyers. Veterans who have been approved for VA HOME loans may transfer the title in order to consolidate the VA loan with another bank to get a new Title III Bank Loan and the same terms and conditions Home bridge Wholesale May 25, 2018-VA home bridge Wholesale is a program to help veterans and their families purchase their home. It is based on the principle that the best thing a person can do to help stabilize their financial situation is to buy a home they can actually afford. Veterans interested in this program and the title loan amount and payment schedule can visit VA Title II Loans and Home Bridge Wholesale Veteran Financial Counselor Resources May 25, 2018- Veterans and their families can now use Veterans Financial Counseling Centers to receive financial counseling, including Veterans Financial Aid and Veterans Education Program. VA is expanding outreach opportunities for non-veterans to use the counseling agencies to find appropriate loan solutions that maximize their ability to succeed. It is especially important for veterans whose education was not covered by VA education benefits to seek out these resources because they will be able to obtain loan approvals under the VA Student Loan program and qualify for VA financial aid. How To Help May 19, 2025 — VA issued new Veteran Financial Support Guidelines to help encourage eligible veterans and their families to have the resources needed to make a mortgage loan or provide financial assistance. “If I was a veteran with an income, I probably couldn't do it,” said Karen Shop, chief executive officer of Trulia. So, as part of the new guidance, the VA is encouraging eligible veteran-owned homeowners to consider the loan options offered by the mortgage companies. “I think the Veterans Financial Assistance (VIA) program is a great opportunity to qualify for loans,” said Shop. In addition, this new guidance is a direct response to the recent VA Secretary's call to help veterans, both on and off bases, “find new ways to live their American dreams” by helping them “build their own dream.

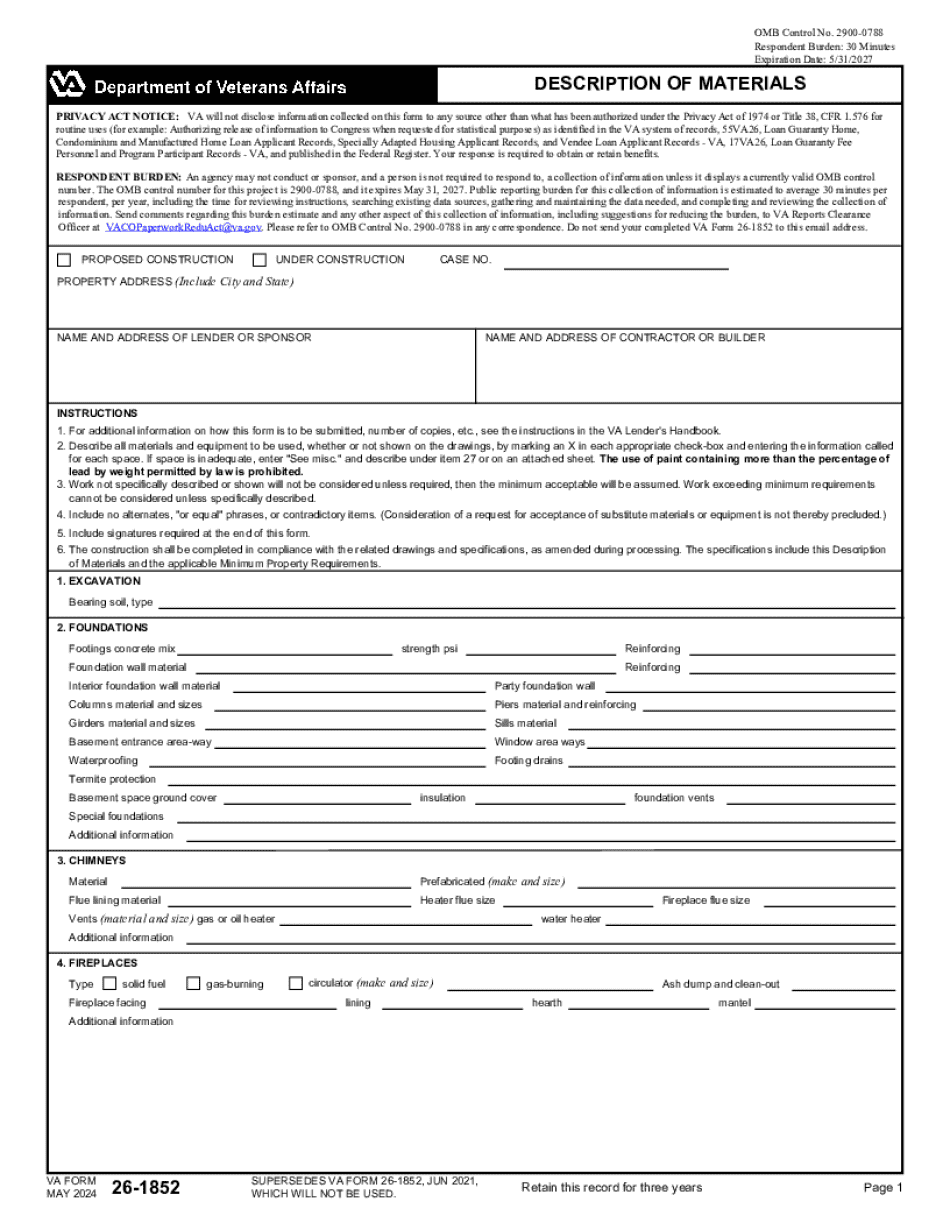

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Va 26-1852, steer clear of blunders along with furnish it in a timely manner:

How to complete any Va 26-1852 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Va 26-1852 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Va 26-1852 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.