Welcome to the reading plans lecture, as part of the fundamentals of construction management course. Here are some quick instructions for this video module: use the buttons at the bottom of the video to navigate the module, pause it, go back, or control volume. You will often take an assessment after each video. For all assessments, please go to the quiz tab in Canvas. For any questions about this content, please consult with the instructor at AP McCoy at VT edu or use the discussion section of the Canvas website. Here are the learning objectives of the reading plans lecture: - Define orthographic projection and drawing types - Identify common orthographic projection drawing types - Define the phases of the architectural drawing process and the parts of a building - Identify specific sections of architectural drawings - Identify types of notations on architectural drawings Previously, in the drafting and architectural techniques lecture, we discussed the concept of orthographic projection. In this slide, I'm trying to show you a better example of how architects traditionally work with a blank piece of paper to create the floor plan and different drawings. Orthographic projection is the drawing's orientation perpendicular to the edge of the paper. That's the basic definition of it. Architects typically use a ruler to draw across the drawing plane, creating a flat drawing plane. In the next slide, we'll see that orthographic projection drawings can be defined in two ways. We discussed this in the previous lecture as well. Multi-view drawings show one static side or view of the building. These drawings are 2-dimensional and include plans, elevations, and sections. You can see an example of these types of drawings to the right. Single-view drawings simultaneously communicate more than one side of an object. They are three-dimensional drawings in the same view. Despite the seemingly backward...

Award-winning PDF software

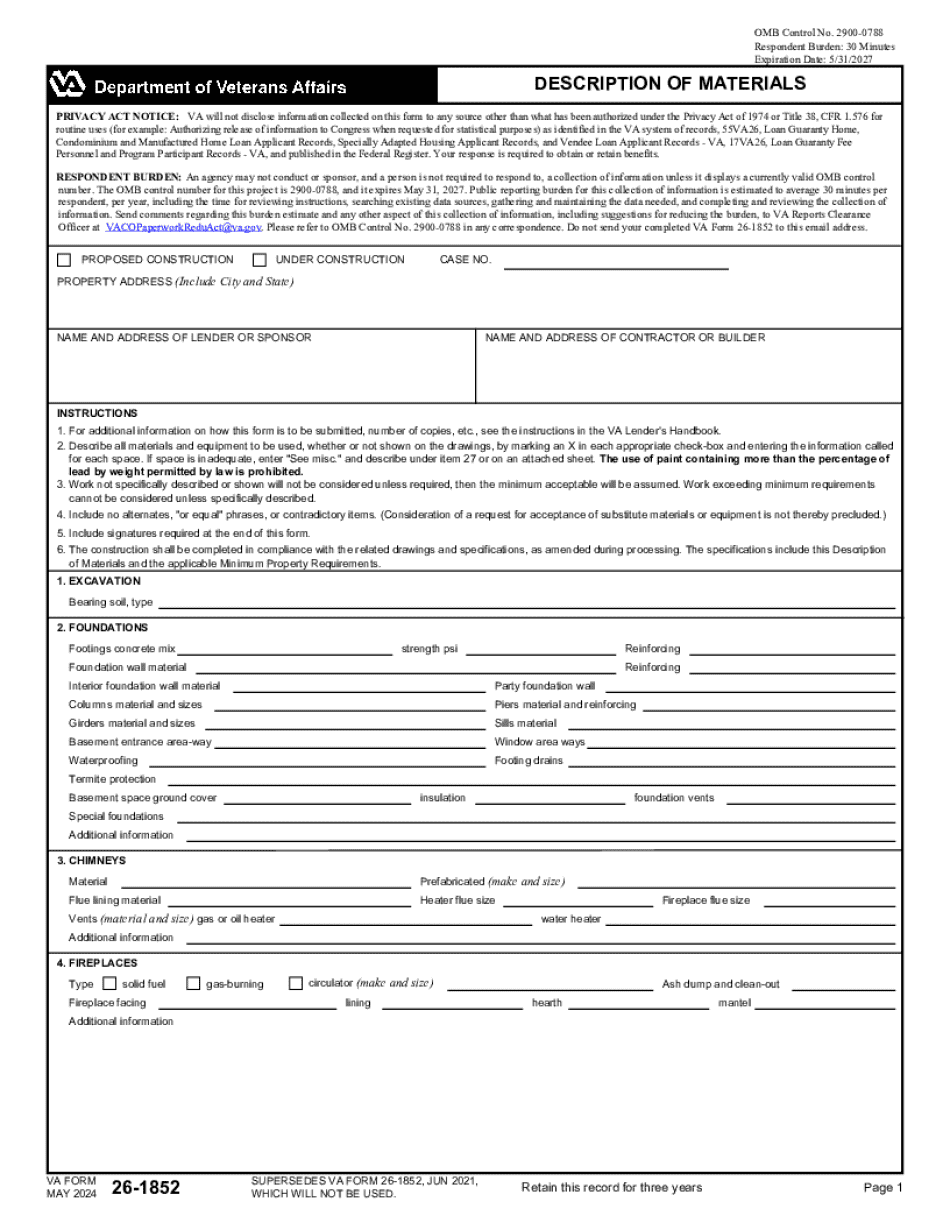

Plumbing specifications of a residential building Form: What You Should Know

T(b)) from 2025 through 2018. 2023 Tax Federal Investment Interest Expense Deduction Limits Investment interest expense paid or accrued under the following tax provisions is allowed under the following limitations: Current year tax law Investment interest expense (as defined by section 1.671-8T(b)) from 2025 through 2019. Income before net taxable capital gains and qualified dividends from an eligible real estate investment trust (REMIT). Any interest paid or accrued on an investment in a qualified small business investment company (SBI) or qualified trade or business investment company (CUBIC) that is not a qualified publicly traded partnership (PTP). Total interest expense paid or accrued under the following tax provisions is allowable under the following limitations: Current year tax law Interest expense from 2025 through 2025 (See IRS Publication 590 (link on your right), IRS publication 590-B (link on your right), and IRS Publication 550 (link on your right). Interest for the taxable year, regardless of whether it may be carried forward or considered a deduction under one of the specified rules from 2025 through 2021. If the maximum allowable limits of interest expense are exceeded as of 2023, the excess amount is deductible as long as the excess can be carried on an eligible retirement account and cannot be carried on a traditional IRA. Investment interest expense from 2025 to 2025 (See instructions). Disallowed: All interest paid as a deduction under the following tax provisions: Investment interest expense from 2025 through 2019. Income before net taxable capital gains and qualified dividends from an eligible real estate investment trust (REMIT) from 2025 and beyond. Nonqualified investments (including interest). Income before net taxable capital gains and qualified dividends from an eligible real estate investment trust (REMIT) from 2025 and beyond. Total interest expense paid or accrued under the following tax provisions is allowable under the following limitations: Income before net taxable capital gains from 2025 to 2021. Investment interest expense from 2025 through 2025 (See instructions). Disallowed: Interest paid as a deduction under the following tax provisions: Investment interest expense from 2025 through 2025 (See instructions). Income before net taxable capital gains from 2025 to 2023.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Va 26-1852, steer clear of blunders along with furnish it in a timely manner:

How to complete any Va 26-1852 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Va 26-1852 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Va 26-1852 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Plumbing specifications of a residential building